Key Takeaways

- The benefits of financial education are clear, yet gaps in financial literacy persist across all generations.

- Key areas for improving financial literacy include budgeting, saving, credit, investing, and retirement planning, which impact individuals at every life stage.

- By offering transparent, accessible financial education, banks can transform customer experiences from transactional to relational, fostering long-term loyalty.

- Integrating financial education into business strategies and leveraging technology can engage customers and promote healthier financial habits.

Listen: Here's why improving financial literacy is great for business.

Who else can remember receiving their very first paycheck? Perhaps some of us even have children who are in this phase of life. Were you excited? Or do you remember feeling completely in the dark about those line items for taxes, insurance, and 401(k) contributions? Were you confident budgeting your income from those early paychecks, or did you feel like you could have used some help?

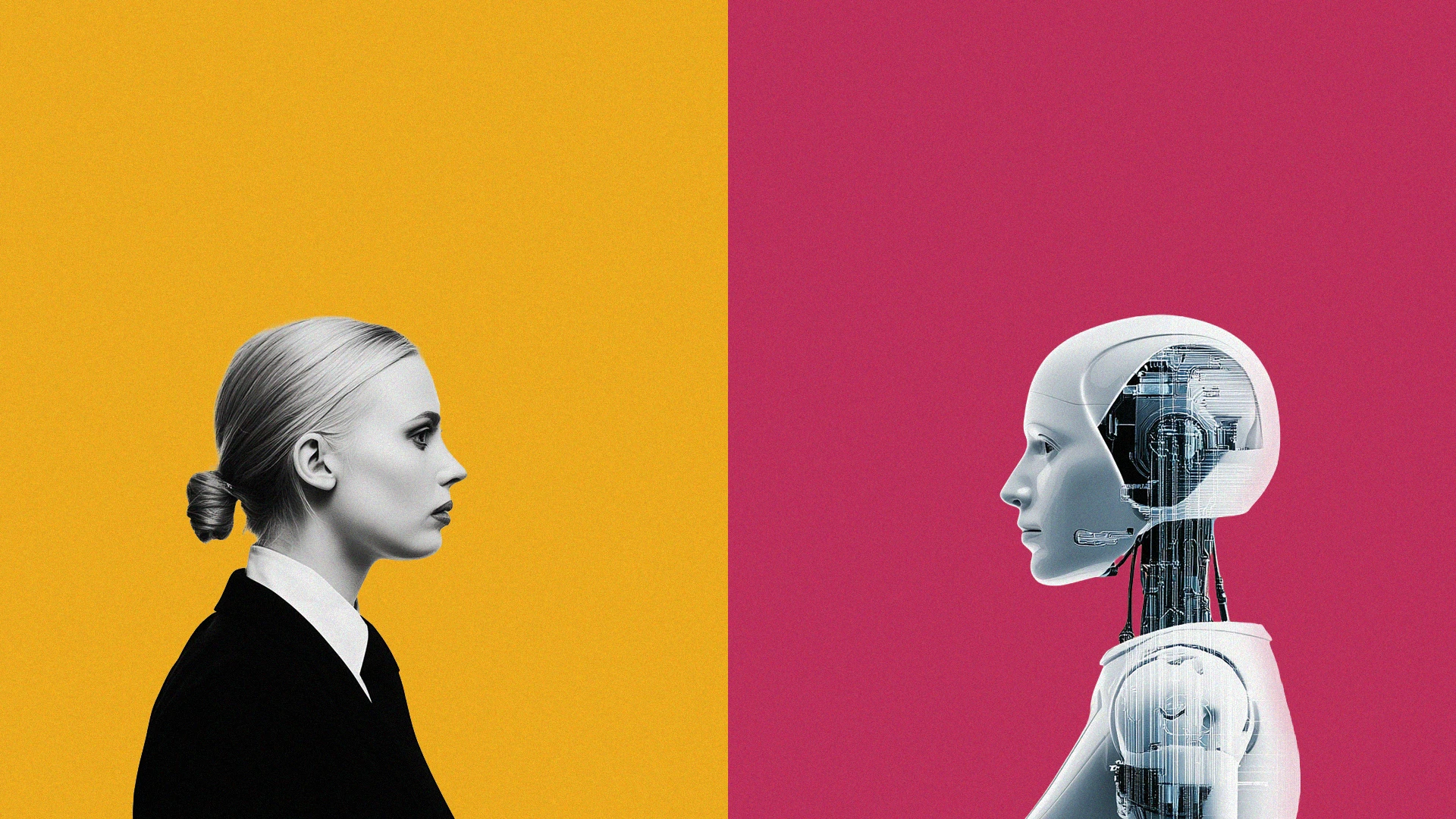

We’ve all faced knowledge gaps in our financial acumen, and people at every stage of life can face uncertainty about money issues. Unfortunately, financial education is a widespread issue that goes beyond teenage budgeting lessons. Financial literacy is lacking across the board, and banks have the opportunity to fill the gaps.

When banks engage customers through financial education there are broad benefits for consumers, including a more educated and empowered society.

Why is financial education important?

The TIAA Institute-GFLEC 2024 study, which assesses financial literacy among U.S. adults, shows big gaps in financial education. Most Americans could only answer half of the financial literacy questions correctly. There’s a clear need to improve financial education for all ages. Here are five key areas where we can make a difference:

- Budgeting.

- Saving.

- Credit.

- Investing.

- Retirement planning.

These key areas are commonly experienced across all types of individuals and families, and across demographics and financial situations. For many, these are issues that come up again and again in life, and present opportunities for banks to connect with and engage customers.

Achieving financial security is vital, but remains daunting for many. Understanding money is a critical tool for life, offering financial security for families—but for many, it’s an overwhelming subject. That’s partly because it’s been overcomplicated. The more banks and financial institutions can simplify things, the more likely people are to engage and feel confident in their own decision-making. When banks can make money matters easy to understand and approachable, the more we can shift engagement from passive to active participation in one's financial health.

The role of banks in financial literacy

Banks are in a unique position to provide trustworthy tools and proactive information to customers. Based on financial institutions’ understanding of customer data and knowledge of their life events, there’s an opportunity to anticipate needs and proactively provide tools and content at those moments that matter.

Benefits for institutions

Customers want to know their bank has their back. When banks take an active role in helping customers succeed, customers are more likely to bank with them for the long haul—using more products and services.

This matters, as banks continue to face risks of customers leaving for another institution. According to the J.D. Power 2024 U.S. Retail Banking Satisfaction Study, fewer than half (46%) of bank customers say they are certain they will remain with their current bank in the next year.

Benefits of financial education

Banks have a unique opportunity to help customers achieve greater financial awareness and confidence. Not for their own benefit, but for customer loyalty and success. Because when customers succeed, banks do, too.

The advantages of financial education can include:

- Avoiding unnecessary fees.

- Establishing emergency funds.

- Creating and sticking to a budget.

- Paying off debt.

- Gaining confidence with investing.

- Creating a plan for the short and long term to achieve financial independence.

Strategies for effective financial education

To unlock these benefits, banks must reframe financial education from a cost center to a long-term investment. The key is building lasting relationships by proving a genuine commitment to customers’ financial well-being.

By positioning itself as a trusted advocate, a bank can strengthen loyalty and become the go-to resource for customers and their families. This shift starts with integrating financial education into core business strategies, meeting customers where they are, and leveraging modern technology to foster trust and long-term engagement.

Align with business goals

First and foremost, financial institutions need to recognize that financial literacy matters and begin to integrate financial education into their products and services. Businesses need to incorporate this priority into their DNA—not just as a warm fuzzy feeling of doing the right thing, but as a necessary business objective with long-term customer care and retention in mind.

Meet customers at eye level

The days of visiting tellers in person or calling financial planners are fading—though not entirely gone. The world is shifting, and today, both consumers and banking are increasingly online.

Yet, financial fitness, like physical fitness, is not a “set it and forget it” approach. It needs to be active rather than passive. In fitness apps, you’re rewarded for hitting 10,000 steps. Banks might consider promoting a “financial health score” that rewards people for saving, paying off credit cards, or building good habits. These little rewards can help reinforce positive behaviors and encourage people to stay engaged.

Another tactic that works is motivation by comparison. Many electric companies have found success in leveraging customers’ neighbors' bills as incentives to reduce energy consumption. The same idea could be applied to financial wellness. This might look like a message that says, “Save $100 more per month, and you’ll be in the top 10% of savers for your age bracket.” These nuts-and-bolts numbers put things into perspective, helping customers see the value of their actions and take control over their choices.

Leverage modern technology

Banks can use AI, apps, and digital tools to create more personalized and proactive opportunities for consumers to engage. From pop-up questions, app alerts, custom financial health scores, and interactive learning experiences like short videos or tutorials, the opportunities abound.

The key? Having a platform that’s easy to understand, visual, and dynamic—something someone can revisit frequently. Banks can succeed with this by making online or in-app tools more interactive, clear, and even fun. User-friendly apps and gamification tools work especially well for Generation Alpha—those born after Gen Z. The right tech can help people see the impact of their decisions to drive real behavioral change.

Build trust

Building trust is one of the most important goals for banks, especially as in-person interactions become less common. Even though face-to-face banking may be on the decline, the human element remains essential. The challenge lies in replicating humanity and empathy through technology—how can banks achieve that?

It starts with avoiding jargon, using plain, clear language, and providing actionable insights. Many institutions have already seen success by leveraging approaches like peer influencers, short-form videos, and in-app pop-ups leveraging AI. AI is a powerful tool that can analyze spending patterns and suggest areas for improvement, helping users manage their finances more effectively.

Banks can also build trust by tackling specific pain points. For example, they can explain fees in simple terms or immediately offer budgeting tools when a new direct deposit arrives. This type of proactive, tailored support comes across as both useful and helpful.

Ultimately, customers want to feel confident they’re being set up for success. They value transparency, a clear understanding of their financial path, and the reassurance that their bank is on their side. When banks communicate in a way that feels relevant, approachable, and easy to digest, customers are more likely to take meaningful steps toward stronger financial health.

Reframing banks as financial advocates

Banks must commit to customer education to create a deeper relationship with customers. Financial leaders need to embed financial education into their DNA to help gain customers’ trust. It’s about investing in resources and technology to create clear, engaging communication and education for customers. There’s great potential for positive change, and banks play a critical role in creating a more financially literate society.

Latest.

Win the 2026 talent race in Canada’s creative sector.

Leadership & Management, Retention Strategies, Talent Acquisition & Recruitment

AI is silently driving the wage gap, here’s how to fix it.

Diversity, Equity & Inclusion, Leadership & Management, Retention Strategies, Innovation & Emerging Tech, Talent Acquisition & Recruitment

10 proven strategies to streamline marketing operations in 2026.

Leadership & Management, Consulting & Operations, Marketing & Analytics